Budget Planner for Finance Organizing

Original price was: $51.05.$31.72Current price is: $31.72.

Take control of your finances with the Budget Planner for Finance Organizing, a comprehensive financial tool designed to help you plan, track, and optimize your monthly budget. Featuring detailed sections for income tracking, expense management, debt repayment, and savings goals, this planner offers everything you need to stay organized and make informed financial decisions. Ideal for individuals, families, or businesses, it’s the perfect solution for achieving financial stability and reaching your money goals.

Description

Budget Planner for Finance Organizing

Specifications:

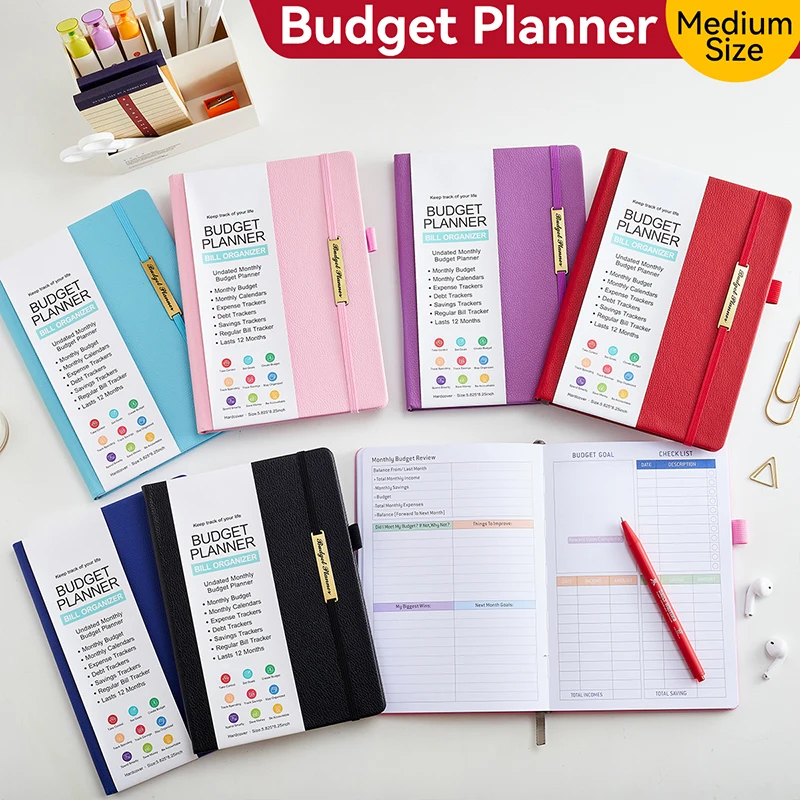

- Model Number: Budget Planner

- Origin: Mainland China

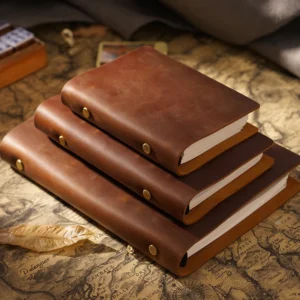

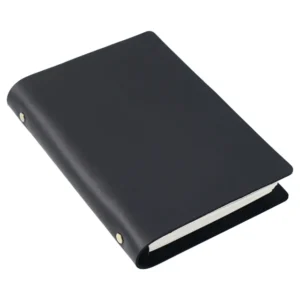

- Size: 148*215mm/5.8*8.46 inch

- Inner Pages: 176page/88sheets

- Cover hardness: Hardcover

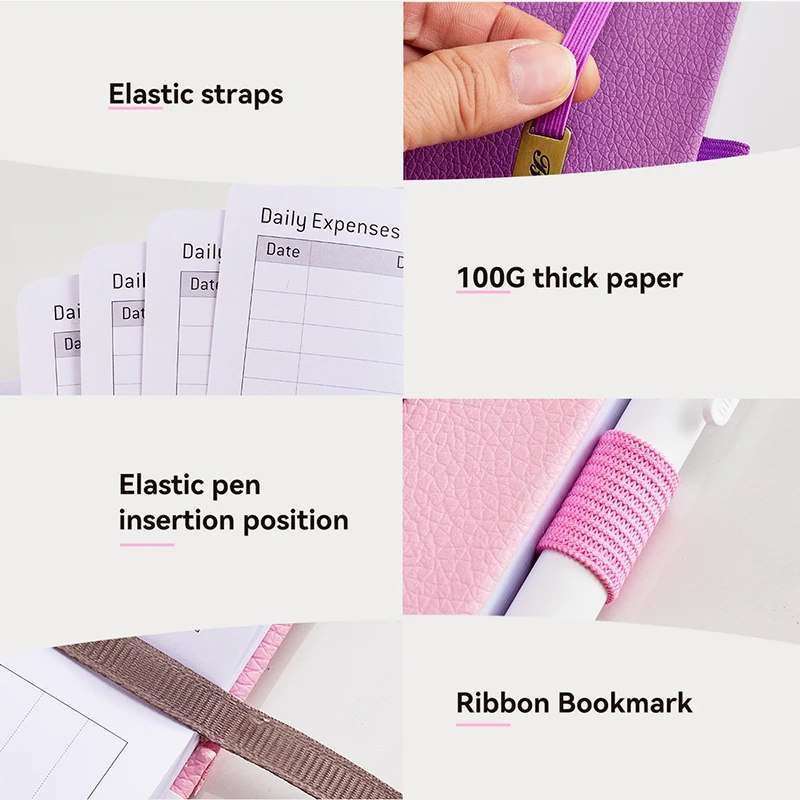

- Page: 100GSM paper

Achieve financial peace of mind and take control of your money with the Budget Planner for Finance Organizing, a meticulously designed planner that offers everything you need to organize your finances, set clear goals, and track your progress throughout the year. Whether you’re looking to save for a major purchase, pay off debt, or simply gain a better understanding of your spending habits, this comprehensive budget planner is the perfect tool to help you build and maintain a healthy financial future. The planner’s structured format makes it easy to break down complex financial information into manageable categories, enabling you to see where your money is going, identify areas for improvement, and plan for future expenses.

The Budget Planner for Finance Organizing features detailed sections for monthly income tracking, expense categorization, savings goal setting, debt repayment plans, and much more. Each page is carefully crafted to provide a clear overview of your financial situation, allowing you to track both short-term and long-term goals. The planner also includes spaces for recording important notes, reminders, and deadlines, making it a versatile tool for managing not just your finances but also your overall financial strategy. With its intuitive layout and user-friendly design, this planner is ideal for individuals, families, or small business owners who want to stay organized and make informed decisions about their money.

Designed with both functionality and aesthetics in mind, the Budget Planner for Finance Organizing is more than just a practical tool—it’s a valuable resource for anyone looking to improve their financial literacy and build wealth over time. The high-quality paper ensures that your entries are clear and legible, while the durable cover and binding make the planner perfect for everyday use. Use it to establish a comprehensive budgeting system, track daily expenses, and celebrate milestones as you work towards your financial goals. With this planner by your side, managing your money has never been easier or more rewarding.

Key Features and Benefits of the Budget Planner for Finance Organizing

Comprehensive Financial Tracking

The Budget Planner for Finance Organizing is equipped with detailed sections to track every aspect of your finances, from monthly income and expenses to long-term savings and debt management. This comprehensive approach ensures that you have a clear picture of your financial health at any given time.

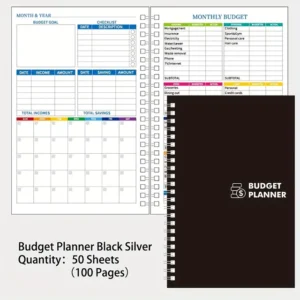

- Monthly Income and Expense Overview: The planner includes dedicated sections for tracking monthly income sources and categorizing expenses, making it easy to see exactly where your money is going each month.

- Savings Goal Tracking: Use the savings goal section to set specific targets for short-term and long-term savings. Track your progress as you work towards goals like emergency funds, vacations, or major purchases.

- Debt Repayment Planner: Plan and track debt repayment strategies with a section designed specifically for managing loans, credit card debt, and other obligations. Visualize your debt reduction over time and stay motivated as you pay down balances.

Goal Setting and Progress Monitoring

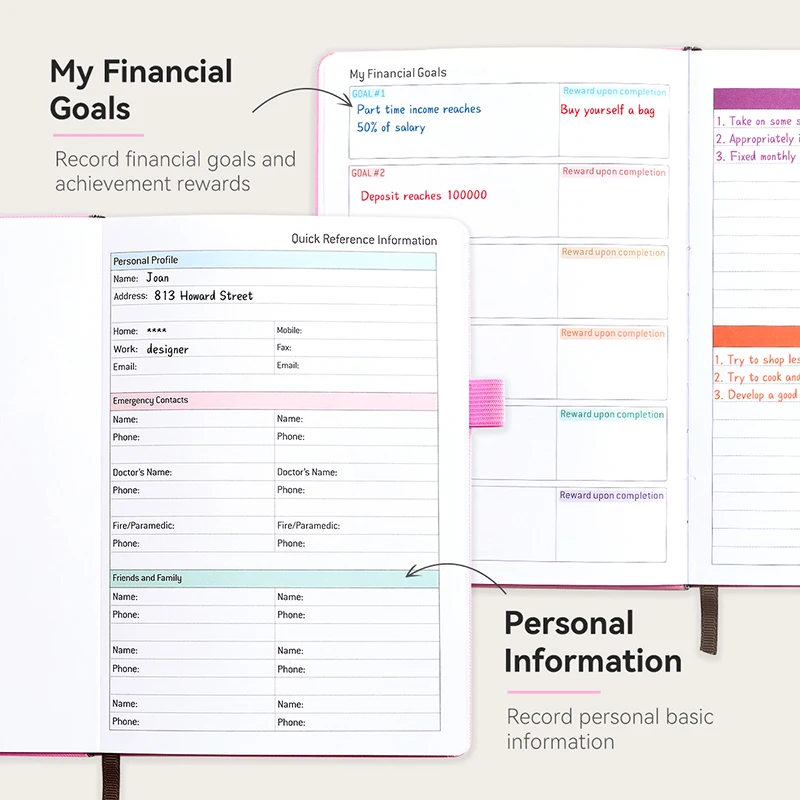

Setting clear financial goals is crucial for building wealth and achieving financial stability. The Budget Planner for Finance Organizing helps you define your financial objectives and monitor your progress over time, making it easier to stay on track and reach your targets.

- Annual and Monthly Goal Sections: Break down your financial goals into manageable monthly and annual targets. This structure helps you create a roadmap for your financial journey, making it easier to measure success and adjust your strategy as needed.

- Progress Tracking Charts: Use visual tracking charts to monitor your progress in real-time. These charts provide a visual representation of your financial milestones, helping you stay motivated and focused on your goals.

- Goal Achievement Checklists: Celebrate your successes with goal achievement checklists that allow you to mark off completed milestones. Recognizing your achievements is a powerful motivator to keep moving forward.

Expense Categorization and Management

One of the keys to successful budgeting is understanding where your money is going. The Budget Planner for Finance Organizing includes detailed sections for categorizing and managing your expenses, helping you identify spending patterns and make informed decisions about your budget.

- Categorized Expense Sections: Organize your spending into categories like housing, utilities, groceries, entertainment, transportation, and more. This granular approach makes it easy to see how much you’re spending in each area and identify opportunities for savings.

- Weekly and Monthly Expense Tracking: Track your expenses on a weekly and monthly basis to gain a deeper understanding of your spending habits. Use these insights to create a more effective budget and prioritize your financial goals.

- Review and Reflection Pages: The planner includes sections for reviewing your monthly spending, reflecting on what worked, and planning for improvements. This reflective process helps you fine-tune your budget and optimize your financial strategy over time.

High-Quality Design for Everyday Use

The Budget Planner for Finance Organizing is designed to be both functional and durable, making it perfect for daily use. The high-quality materials ensure that your entries are clear and easy to read, while the sleek design makes it a pleasure to use and display.

- Durable Cover and Binding: The sturdy cover and reliable binding protect the planner from wear and tear, ensuring that it holds up even with daily use. The planner is designed to last for the entire year, providing a consistent resource for your financial planning needs.

- Premium Paper for a Smooth Writing Experience: The planner is made with high-quality paper that resists bleed-through, ensuring that your entries are neat and legible. The smooth surface makes writing a pleasure, whether you’re using pens, markers, or highlighters.

- Compact and Portable Size: The planner’s compact size makes it easy to carry in a bag or backpack, allowing you to track your finances on the go. Use it at home, in the office, or while traveling to stay on top of your budget at all times.

Creative Uses for the Budget Planner for Finance Organizing

- Track Family Finances: Use the planner to track and manage household income, expenses, and savings goals. It’s perfect for coordinating family budgets and ensuring that everyone is on the same page financially.

- Manage Small Business Finances: Use the planner to track business income, expenses, and cash flow. It’s a valuable tool for entrepreneurs and small business owners who want to maintain financial clarity and make informed decisions.

- Plan for Major Life Events: Use the planner to budget for major life events, such as weddings, vacations, or home renovations. Break down each event’s costs and set savings goals to ensure that you’re financially prepared.

- Track Multiple Savings Goals: Use the planner’s goal-tracking sections to set and monitor multiple savings goals, such as building an emergency fund, saving for a new car, or planning for retirement.

- Create a Debt-Free Strategy: Use the debt repayment sections to create a comprehensive strategy for becoming debt-free. Track your progress, celebrate milestones, and stay motivated as you pay down balances.

Achieve Financial Success with the Budget Planner for Finance Organizing — Your Essential Tool for Budgeting, Tracking, and Achieving Financial Goals

Take charge of your financial future with the Budget Planner for Finance Organizing, a meticulously designed tool that goes beyond traditional budgeting to provide a comprehensive framework for financial success. Whether you’re managing your personal finances, tracking household expenses, or overseeing a small business budget, this planner is equipped with everything you need to organize your financial life, set clear goals, and monitor your progress with ease. From categorizing monthly expenses and recording income sources to creating strategic savings plans and debt repayment strategies, this planner helps you gain a complete understanding of your financial situation, enabling you to make informed decisions and build a solid foundation for long-term wealth.

The Budget Planner for Finance Organizing is structured to break down complex financial information into manageable sections, making it easy for you to see where your money is going, adjust your spending habits, and optimize your budget. Each page is thoughtfully laid out to guide you through key areas of financial planning, including setting monthly and yearly goals, tracking debt, monitoring expenses, and planning for future investments.

With this planner, you can create a personalized financial strategy that aligns with your unique needs and goals, whether that means building an emergency fund, saving for a down payment on a house, or paying off student loans. By providing a clear and structured approach to financial management, the Budget Planner for Finance Organizing empowers you to take control of your money, eliminate financial stress, and achieve your dreams.

Designed for both beginners and experienced budgeters, the Budget Planner for Finance Organizing is suitable for anyone looking to improve their financial health. It offers a variety of features that make it easy to track and analyze your spending, set realistic goals, and stay motivated along your financial journey. The planner’s high-quality design ensures that it will withstand daily use, while its stylish and compact format makes it a pleasure to use. Whether you’re carrying it in your bag for on-the-go tracking or keeping it at your desk for daily check-ins, the planner’s durable construction and elegant appearance make it a valuable addition to your financial toolkit.

Key Features and Benefits of the Budget Planner for Finance Organizing

Detailed Financial Overview for Complete Clarity

The Budget Planner for Finance Organizing offers a comprehensive layout that covers every aspect of your financial life, providing a clear picture of your income, expenses, savings, and debt. This holistic approach helps you understand your financial situation at a glance, making it easy to see where you stand and identify areas for improvement.

- Income Tracking for All Sources: Record your monthly income from various sources, including salary, freelance work, investments, or side businesses. This section helps you see exactly how much money is coming in and allows you to compare it against your expenses.

- Expense Management for Better Budgeting: Break down your spending into detailed categories such as housing, utilities, groceries, transportation, entertainment, and more. Understanding where your money is going is the first step toward creating a budget that works for you.

- Savings and Investment Planning: Plan for future financial stability by tracking your savings contributions and investment growth. Use the dedicated sections for tracking your emergency fund, retirement savings, or other long-term financial goals.

- Debt Repayment Strategies: Create a plan for paying down debt, including credit cards, student loans, mortgages, or other financial obligations. Track your progress over time and celebrate as you reduce your balances and move closer to becoming debt-free.

Structured Goal Setting for Long-Term Success

Setting and achieving financial goals is a key component of building wealth and reaching financial independence. The Budget Planner for Finance Organizing is designed to help you define clear financial objectives and break them down into actionable steps, ensuring that you stay focused and motivated along the way.

- Annual and Monthly Goal Sections: Start by setting high-level financial goals for the year, such as saving a specific amount, paying off debt, or reducing monthly expenses. Then, break these larger goals down into smaller monthly targets that are easier to track and achieve.

- Goal Progress Tracking: Use the progress tracking charts to visualize your achievements and stay motivated. Seeing your progress in a tangible form can provide the encouragement you need to keep pushing forward, even when challenges arise.

- Goal Reflection and Adjustment: At the end of each month, use the reflection pages to assess your progress, identify any setbacks, and make adjustments to your plan as needed. This continuous review process helps you stay on track and adapt to changing circumstances.

- Celebrate Milestones: Recognizing and celebrating your achievements is an important part of the goal-setting process. Use the milestone markers to celebrate when you reach key financial milestones, such as saving your first $1,000 or becoming debt-free.

Expense Categorization and Management

The key to effective budgeting is understanding your spending habits. The Budget Planner for Finance Organizing provides detailed sections for categorizing and managing your expenses, helping you pinpoint areas where you may be overspending and find opportunities to save.

- Categorized Expense Sections for Insightful Analysis: Track your spending in categories such as housing, food, transportation, and entertainment. This detailed breakdown helps you identify which areas of your budget are consuming the most resources and make informed decisions about where to cut back.

- Weekly and Monthly Expense Tracking: Record your expenses on a weekly and monthly basis to gain a clearer picture of your spending patterns. Use this information to adjust your budget and prioritize your spending based on your goals.

- Visual Expense Analysis: Use visual tools like pie charts and bar graphs to see how your expenses are divided among different categories. These visual aids make it easy to spot trends and areas that may need attention.

- Expense Review and Optimization: At the end of each month, use the review section to reflect on your spending, assess what went well, and identify areas for improvement. This process helps you optimize your budget and align your spending with your financial goals.

Savings and Debt Management Tools

Effective savings and debt management are crucial for achieving financial stability and building wealth. The Budget Planner for Finance Organizing includes specialized tools for setting savings goals, planning debt repayment, and monitoring your progress.

- Savings Goal Tracker: Use the savings goal tracker to set specific targets for your emergency fund, vacation savings, or other financial goals. Track your progress each month and see your savings grow over time.

- Debt Repayment Planner: Create a customized debt repayment plan that outlines your strategy for paying off loans, credit cards, or other debts. Track each payment and see your total debt balance decrease as you work towards financial freedom.

- Emergency Fund Tracker: Build an emergency fund to cover unexpected expenses and provide financial security. Use the tracker to set a target amount and monitor your contributions each month.

High-Quality Design and Construction for Daily Use

The Budget Planner for Finance Organizing is built to last, with high-quality materials that ensure durability and longevity. Its compact, stylish design makes it a pleasure to use, whether you’re tracking your finances at home or on the go.

- Premium Cover and Binding: The planner’s durable cover protects it from wear and tear, while the sturdy binding ensures that it stays intact throughout the year. The premium construction makes it perfect for everyday use.

- Thick, Smooth Paper for a Pleasant Writing Experience: The planner is made with high-quality paper that resists bleed-through and provides a smooth writing surface. This makes it easy to keep your entries neat and organized, whether you’re using pens, markers, or highlighters.

- Compact and Portable: The planner’s compact size makes it easy to carry with you, so you can track your finances wherever you go. Use it at home, in the office, or while traveling to stay on top of your financial goals.

Why Choose the Budget Planner for Finance Organizing?

The Budget Planner for Finance Organizing is more than just a budgeting tool—it’s a comprehensive financial management system that helps you build a better future. With its detailed sections for income tracking, expense management, savings goal setting, and debt repayment, this planner provides everything you need to create a clear, actionable financial plan. Invest in the Budget Planner for Finance Organizing today and take control of your money, reduce financial stress, and achieve your dreams with confidence!

Reviews

There are no reviews yet.