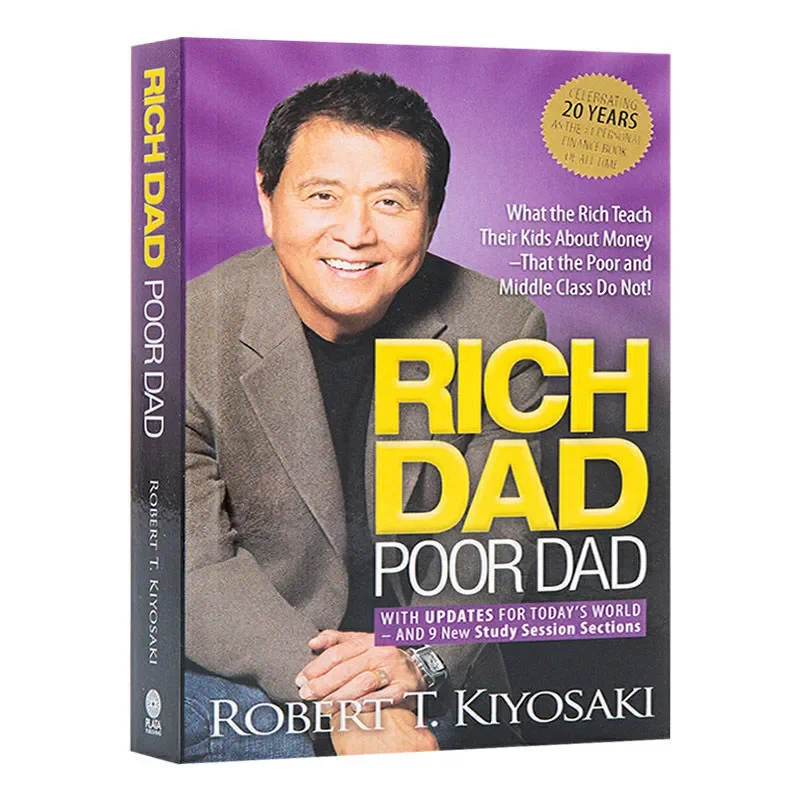

Children Books for Financial Intelligence RICH DAD POOR DAD by Robert Toru Kiyosaki

Original price was: $37.39.$23.52Current price is: $23.52.

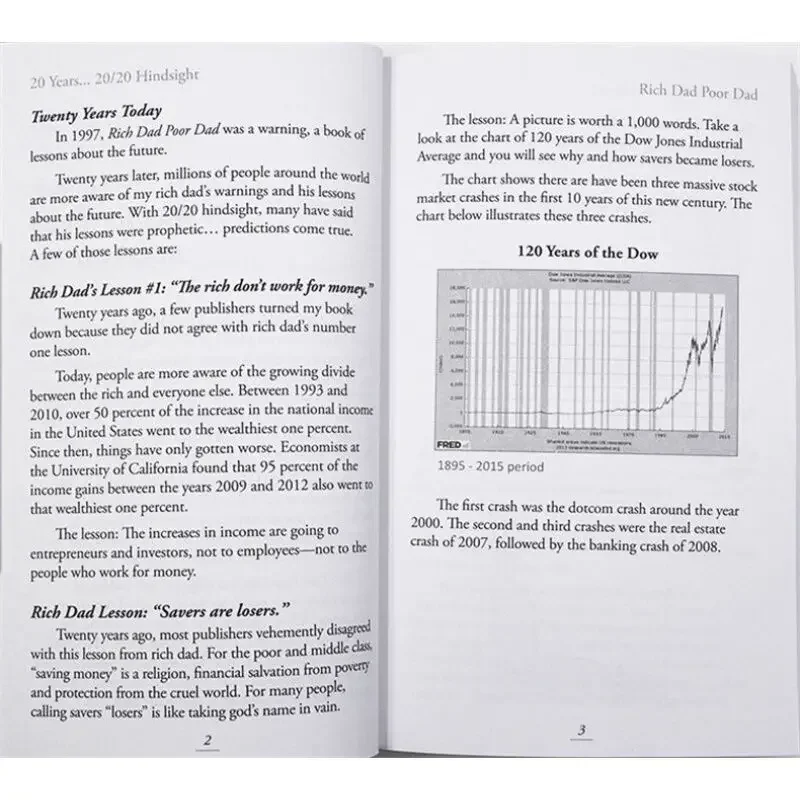

Introduce children to the basics of financial intelligence with the children’s version of Rich Dad Poor Dad by Robert Toru Kiyosaki. This engaging and simplified adaptation offers young readers a kid-friendly approach to money management, investments, and understanding financial freedom. Through relatable stories and easy-to-understand concepts, children will learn the difference between assets and liabilities, the importance of saving, and the power of making smart financial decisions early in life.

Description

Children Books for Financial Intelligence RICH DAD POOR DAD by Robert Toru Kiyosaki

Specifications:

- Version: New

- Format: Paperback

- Binding: Fine Binding

- Publication Year: 2010-Now

- Language: English

- Age: Teen & Young Adult

- Condition: New

- Original language: English

- Series: new

- Publisher: New

- Origin: Mainland China

Empower young readers with essential financial skills through the children’s adaptation of Rich Dad Poor Dad by Robert Toru Kiyosaki. This child-friendly version of the international bestseller simplifies the core lessons of financial literacy for a younger audience, making it easier for children to understand the value of money, the importance of saving, and how to grow wealth through smart investments. Through engaging storytelling and colorful illustrations, kids will learn about the difference between assets and liabilities, how to make money work for them, and the importance of making financially responsible decisions.

Inspired by the original concepts in Kiyosaki’s book, this children’s version of Rich Dad Poor Dad takes the complex world of finance and breaks it down into relatable lessons for kids. It encourages early financial education, helping children build a solid foundation for understanding money. The simplified content teaches the importance of budgeting, saving, and investing in an age-appropriate way, using relatable examples and easy-to-follow explanations.

This book is perfect for parents, educators, or caregivers looking to introduce financial literacy to children. Whether you’re looking to teach the basics of budgeting or foster an entrepreneurial mindset, this version of Rich Dad Poor Dad offers an engaging and accessible way to help kids develop good money habits. It’s a fun and educational resource that inspires children to think critically about their financial future and lays the groundwork for financial independence.

Key Features and Benefits of the Children’s Rich Dad Poor Dad

Kid-Friendly Financial Concepts

The children’s version of Rich Dad Poor Dad simplifies complex financial ideas and makes them easy for kids to understand. Through age-appropriate language and storytelling, this book introduces children to the core principles of financial intelligence.

- Simple Explanations of Money Concepts: The book breaks down key financial ideas like assets, liabilities, passive income, and saving in a way that is easy for children to grasp. It helps kids understand the basics of money management, making it a valuable learning tool.

- Relatable Storytelling: By following the journey of a young character learning from two different father figures, children can relate to the story and see how different approaches to money management lead to different outcomes. The lessons are woven into engaging narratives that captivate young readers.

- Visual Learning with Illustrations: Colorful illustrations and diagrams help reinforce the lessons in the book, making it fun and interactive for children. Visual aids support their understanding of concepts such as earning money, saving, and investing.

Teaches Essential Financial Skills for the Future

The book focuses on teaching children skills that will benefit them throughout their lives, such as budgeting, saving, investing, and making smart financial decisions. These lessons lay the groundwork for financial independence and long-term success.

- Understanding Assets vs. Liabilities: One of the key takeaways from the book is teaching children the difference between assets (things that make money) and liabilities (things that cost money). Kids learn to value the idea of building assets to create financial security.

- Encourages Saving and Wise Spending: Through real-life examples and simple activities, children are encouraged to save their money rather than spend it all. The book helps them see the importance of planning for the future and managing money responsibly.

- Inspiring an Entrepreneurial Mindset: The book introduces the concept of entrepreneurship, teaching children that they can create wealth by starting their own businesses or investing in their own ideas. This message encourages children to think creatively about ways to generate income.

Promotes Early Financial Literacy

Building financial literacy at a young age helps children develop good habits and attitudes towards money that will serve them throughout their lives. The children’s adaptation of Rich Dad Poor Dad promotes financial awareness from an early age.

- Foundational Financial Education: By introducing financial concepts at a young age, this book helps children build a strong foundation in understanding how money works. The lessons taught in the book prepare them to make smarter financial decisions as they grow older.

- Encourages Critical Thinking About Money: The book prompts children to think critically about how they handle money, encouraging them to ask questions like, “What can I do to make money work for me?” and “How can I invest my money wisely?”

- Promotes Financial Independence: By learning the basics of financial literacy, children are empowered to make decisions that will lead them to financial independence. The book shows kids that by being financially savvy, they can achieve their goals and build the future they want.

Fun and Engaging Format for Young Readers

The children’s version of Rich Dad Poor Dad is designed to be engaging and entertaining, ensuring that kids enjoy learning about financial literacy.

- Interactive Activities and Quizzes: The book includes activities and quizzes to test children’s understanding of financial concepts, keeping them actively involved in the learning process. These exercises make learning about money fun and interactive.

- Character-Driven Stories: The relatable characters in the book help bring financial lessons to life. Kids will be inspired by the main character’s journey and will enjoy seeing how the different financial lessons play out in everyday life scenarios.

- Colorful and Kid-Friendly Design: The vibrant illustrations and kid-friendly design make the book visually appealing, encouraging children to pick it up and read it. The layout is designed to keep young readers engaged from start to finish.

Creative Uses for Children’s Rich Dad Poor Dad

- Introduce Financial Literacy at Home: Parents can use the book to introduce the concepts of saving, budgeting, and investing to their children in a fun and interactive way. It’s a great way to start conversations about money management at home.

- Classroom Tool for Teaching Financial Skills: Teachers can use this book as part of their curriculum to teach students about the basics of money and finance. The activities and quizzes make it easy to integrate into classroom lessons.

- Gift for Kids Interested in Money Management: This book makes a thoughtful gift for children who are curious about how money works or who want to start learning about financial responsibility at an early age.

- Family Financial Learning Sessions: Families can read the book together and discuss the lessons learned. It can be a great way to engage children in family financial planning and teach them about the importance of financial independence.

Cultivating Financial Intelligence in Kids with Rich Dad Poor Dad by Robert Toru Kiyosaki — The Ultimate Guide to Teaching Money Management and Financial Literacy to Children

Financial literacy is one of the most critical life skills children can learn, yet it’s often not taught in traditional school curriculums. Enter the Children’s Edition of Rich Dad Poor Dad by Robert Toru Kiyosaki, an essential guide that brings the powerful lessons of money management and financial independence to young readers. This children’s adaptation simplifies the life-changing concepts of the original bestseller, breaking them down into engaging, easy-to-understand lessons perfect for kids who are just beginning to learn about money.

In today’s world, the ability to manage money effectively and understand financial concepts early in life can set children on a path toward financial success. The Children’s Rich Dad Poor Dad introduces core financial principles such as budgeting, saving, investing, and understanding the difference between assets and liabilities. With the help of fun stories, relatable characters, colorful illustrations, and interactive activities, this book teaches kids how to make smarter decisions about money, fostering a mindset of financial empowerment from an early age.

Whether you’re a parent who wants to start teaching your kids about financial responsibility or an educator looking for a valuable tool to incorporate financial literacy into your classroom, this version of Rich Dad Poor Dad is the perfect resource. It provides a solid foundation for kids to begin thinking critically about money, making smart financial choices, and even considering entrepreneurial endeavors. Help your child understand how money works and give them the tools they need for a brighter financial future with the Children’s Rich Dad Poor Dad.

Key Features and Benefits of Children’s Rich Dad Poor Dad

Kid-Friendly Adaptation of Complex Financial Concepts

The Children’s Rich Dad Poor Dad takes the often complex world of finance and simplifies it for young readers, making it easy for kids to grasp key financial concepts.

- Simplified Explanations for Young Minds: This children’s version of the original book breaks down concepts like assets, liabilities, passive income, and saving in a way that’s approachable for kids. The book uses language and examples that children can relate to, ensuring that the lessons make sense and are easy to follow.

- Engaging Stories with Practical Lessons: The book features stories about the experiences of two fictional characters, based on the author’s own life experiences with his “rich” and “poor” dads. Through these stories, kids learn how different attitudes toward money can shape financial outcomes. The narrative approach makes the lessons engaging and memorable.

- Visual Learning Through Illustrations: The book is filled with colorful, kid-friendly illustrations and diagrams that support the lessons being taught. Whether it’s demonstrating how money flows or showing the difference between an asset and a liability, the visuals make the financial concepts more tangible and easier to understand.

Instills Important Financial Values Early

Introducing financial literacy at a young age can have lifelong benefits. The Children’s Rich Dad Poor Dad equips kids with the knowledge and mindset they need to develop good financial habits from the start.

- Learning the Difference Between Assets and Liabilities: One of the core lessons in Rich Dad Poor Dad is understanding what assets are (things that make money for you) versus liabilities (things that cost you money). Teaching kids to recognize this distinction early on helps them prioritize saving and investing for the future.

- Encourages Responsible Spending and Saving: Through relatable examples and fun activities, the book encourages kids to think before they spend, helping them learn the importance of saving and budgeting. This lesson sets the stage for financial discipline and goal-setting as they grow.

- Developing an Entrepreneurial Mindset: The children’s version of the book introduces the idea of entrepreneurship, helping kids understand that they can create wealth by starting their own ventures or investing in their ideas. This encourages creativity, problem-solving, and critical thinking about how to generate income, even at a young age.

- Planning for Financial Independence: By learning the value of saving, investing, and making wise financial decisions, kids are taught to aim for financial independence. They’ll understand that it’s possible to grow wealth by making money work for them rather than simply working for money.

Fosters Critical Thinking About Money and Finance

The Children’s Rich Dad Poor Dad encourages kids to ask questions and think critically about how they manage their money, preparing them for real-world financial decisions in the future.

- Encourages Strategic Thinking About Money: Through lessons about saving, investing, and recognizing opportunities to grow wealth, the book helps kids think strategically about their financial decisions. They’ll learn to consider their financial goals and plan for the future rather than focusing solely on short-term desires.

- Teaches the Value of Passive Income: By introducing the concept of passive income, the book shows kids that it’s possible to earn money even when they’re not actively working for it. This lesson encourages them to think about long-term investments and how they can use their money to generate more wealth over time.

- Promotes Financial Self-Reliance: The book teaches kids that they can achieve financial success by making informed decisions and taking control of their financial destiny. By fostering a sense of financial self-reliance, children are empowered to take ownership of their financial futures.

Engaging Format with Activities and Interactive Learning

To ensure that young readers stay engaged and actively participate in their learning, the Children’s Rich Dad Poor Dad includes activities and interactive elements designed to reinforce key financial concepts.

- Fun and Interactive Activities: The book includes quizzes, games, and activities that encourage kids to apply what they’ve learned. These exercises make learning about money fun while testing their understanding of concepts like saving, investing, and budgeting.

- Relatable Characters: The book’s characters, who are modeled after the “rich dad” and “poor dad” in Kiyosaki’s life, help illustrate different financial mindsets and outcomes. These characters are easy for kids to relate to, making the financial lessons feel more personal and accessible.

- Engaging Visuals and Storytelling: The colorful illustrations and engaging storytelling style capture children’s attention and make financial concepts easier to grasp. By combining visual learning with clear, relatable stories, the book keeps young readers interested and invested in the material.

Creative Uses for the Children’s Rich Dad Poor Dad

- Teach Financial Literacy at Home: Parents can use the book as a tool to teach their children about money management. It’s an excellent resource for starting discussions about finances, encouraging kids to ask questions and think about their financial decisions.

- Integrate Financial Education in Classrooms: Teachers can incorporate this book into their lesson plans to introduce financial literacy to students. The interactive activities and relatable stories make it a great fit for elementary and middle school classrooms.

- Gift for Young Entrepreneurs: If your child or a child you know shows interest in starting their own business or learning about money, this book makes a thoughtful gift. It’s an educational resource that provides long-term value and helps foster an entrepreneurial spirit.

- Family Financial Learning Time: Families can read the book together, discussing its lessons and how they apply to real-life financial situations. This can spark meaningful conversations about family financial goals and teach kids the importance of financial responsibility.

- Extracurricular Learning Programs: Financial education programs or after-school clubs can use this book as part of their curriculum to teach children about financial literacy in a fun and engaging way.

Why Choose the Children’s Version of Rich Dad Poor Dad?

The Children’s Rich Dad Poor Dad is more than just a book—it’s a practical guide to teaching children the fundamentals of money management in an engaging and accessible way. Through simplified lessons on assets, liabilities, saving, and investing, children are empowered to think critically about their financial choices and build a strong foundation for their future.

As parents, educators, or caregivers, you’ll find that this book provides an excellent opportunity to teach kids about the value of financial intelligence, fostering habits that will help them throughout their lives. By equipping children with the knowledge and tools to make smart financial decisions, the Children’s Rich Dad Poor Dad sets them on a path toward financial independence and long-term success.

Give your child the gift of financial literacy and help them start thinking like a “rich dad” from an early age with the Children’s Rich Dad Poor Dad by Robert Toru Kiyosaki—an invaluable resource for building a brighter financial future!

Books for FinancialBooks for FinancialBooks for FinancialBooks for FinancialBooks for FinancialBooks for FinancialBooks for FinancialBooks for FinancialBooks for FinancialBooks for FinancialBooks for FinancialBooks for FinancialBooks for FinancialBooks for FinancialBooks for FinancialBooks for FinancialBooks for FinancialBooks for FinancialBooks for FinancialBooks for FinancialBooks for FinancialBooks for FinancialBooks for FinancialBooks for FinancialBooks for FinancialBooks for FinancialBooks for FinancialBooks for FinancialBooks for FinancialBooks for FinancialBooks for FinancialBooks for FinancialBooks for FinancialBooks for FinancialBooks for FinancialBooks for FinancialBooks for FinancialBooks for FinancialBooks for FinancialBooks for FinancialBooks for FinancialBooks for FinancialBooks for FinancialBooks for FinancialBooks for FinancialBooks for FinancialBooks for FinancialBooks for FinancialBooks for FinancialBooks for FinancialBooks for FinancialBooks for FinancialBooks for FinancialBooks for FinancialBooks for FinancialBooks for Financial

Reviews

There are no reviews yet.