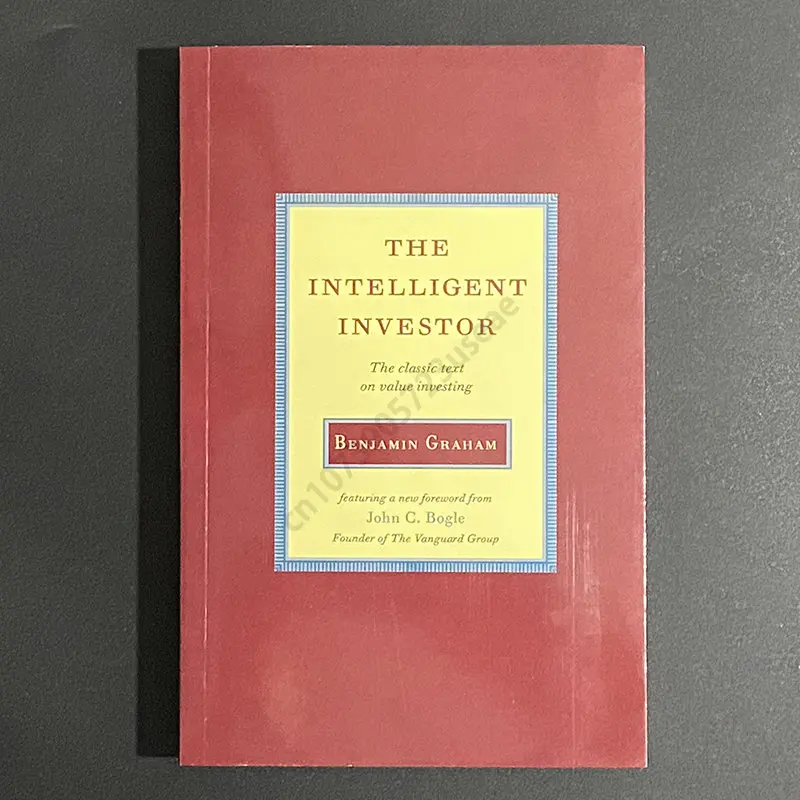

The Intelligent Investor Book for Adult Financial Management

Original price was: $44.17.$29.43Current price is: $29.43.

Transform your approach to investing with The Intelligent Investor, an essential guide to adult financial management written by Benjamin Graham. This timeless book offers practical strategies for making smart, informed investment decisions, mastering market behavior, and building long-term financial security. Whether you’re a beginner or an experienced investor, this comprehensive guide provides the knowledge you need to make intelligent decisions, avoid common investment pitfalls, and achieve financial independence.

498 in stock

Description

The Intelligent Investor Book for Adult Financial Management

Specifications:

- Format: Paperback

- Binding: Fine Binding

- Publication Year: 2010-Now

- Language: English

- Age: ADULT

- Condition: New

- Origin: Mainland China

- Number of pages: Page 100-200

- Original language: English

- Paper Type: Art paper

- Type1: Livre

- Type2: Livros

- Type3: Libro

Achieve long-term financial success with The Intelligent Investor, a comprehensive guide to adult financial management and investing written by Benjamin Graham. Widely regarded as one of the greatest investment books of all time, The Intelligent Investor provides a roadmap for making smart, well-informed financial decisions that help you build wealth, avoid common investment mistakes, and navigate the complexities of market behavior. With Graham’s practical wisdom, readers can learn how to adopt a disciplined approach to investing, manage risk effectively, and develop strategies that stand the test of time.

The Intelligent Investor is designed for adults who are serious about taking control of their financial future. Whether you’re just starting out in the world of investing or have years of experience, this book offers valuable insights into everything from market fluctuations and value investing to understanding risk and reward. Graham’s approach focuses on the concept of “value investing,” which teaches investors how to identify undervalued stocks and make sound, long-term investment decisions based on careful analysis rather than market speculation.

With easy-to-follow explanations, real-world examples, and timeless investment principles, The Intelligent Investor provides a step-by-step guide to mastering the art of financial management. From understanding market trends and minimizing risks to identifying the most profitable investment opportunities, this book equips you with the tools and strategies you need to build and maintain wealth over time. It is a must-read for anyone looking to create a secure financial future, navigate the stock market with confidence, and make informed, intelligent investment decisions.

Key Features and Benefits of The Intelligent Investor

Comprehensive Investment Strategies for Adults

The Intelligent Investor provides readers with a clear, actionable framework for developing investment strategies that lead to long-term financial success. Graham’s approach focuses on the core principles of value investing, offering insights into how to build wealth intelligently and sustainably.

- Introduction to Value Investing: Learn the fundamentals of value investing, a strategy that involves identifying undervalued stocks with strong long-term growth potential. Graham explains how to avoid speculative investments and instead focus on finding companies with solid financial foundations.

- Principles of Risk Management: Graham’s teachings emphasize the importance of managing risk effectively. The book provides readers with tools and strategies for minimizing losses, balancing risk with reward, and making smart financial decisions that stand the test of time.

- Long-Term Wealth-Building Techniques: Rather than focusing on short-term gains, The Intelligent Investor encourages readers to adopt a long-term approach to wealth-building. Learn how to create a diversified investment portfolio, manage market volatility, and make decisions that help you build and maintain financial security over the long run.

Timeless Financial Wisdom from a Legendary Investor

Benjamin Graham, widely regarded as the father of value investing, shares timeless financial wisdom that has helped generations of investors build lasting wealth. The Intelligent Investor remains relevant today because of its practical, down-to-earth advice on navigating the financial markets.

- Practical Investment Advice: Graham’s teachings are grounded in real-world investment experience, offering readers clear, practical advice on how to evaluate stocks, avoid emotional decision-making, and stick to a disciplined investment strategy.

- Understanding Market Behavior: The book delves into the psychology of investing, helping readers understand how market trends and investor behavior can impact stock prices. Graham’s insights into market behavior help investors avoid common pitfalls and make informed decisions even in volatile market conditions.

- Avoiding Common Investment Mistakes: The Intelligent Investor outlines common investment mistakes and how to avoid them. Whether it’s chasing after speculative stocks, reacting emotionally to market swings, or neglecting proper research, Graham provides guidance on how to make better financial choices.

A Guide for Investors at Every Stage

Whether you’re new to investing or have years of experience, The Intelligent Investor is designed to meet you where you are in your financial journey. The book is packed with insights that are valuable for both novice and experienced investors alike.

- Beginner-Friendly Explanations: For those just starting out, the book explains key investment concepts in simple, easy-to-understand language. It provides a solid foundation in financial literacy, helping beginners feel confident about entering the world of investing.

- Advanced Insights for Seasoned Investors: Experienced investors will find valuable insights that help refine their existing strategies. The book offers in-depth analysis and advanced techniques for those looking to take their investment game to the next level.

- Real-World Case Studies and Examples: Graham includes real-world case studies and examples to illustrate how his investment strategies play out in real financial markets. These examples provide practical applications of the principles discussed, helping readers see how they can apply the concepts in their own portfolios.

Focused on Long-Term Financial Security

One of the key themes of The Intelligent Investor is the importance of focusing on long-term financial security rather than short-term gains. Graham encourages readers to adopt a patient, disciplined approach to investing, emphasizing the value of consistency and careful analysis over time.

- Building a Diversified Portfolio: Graham teaches readers the importance of diversification as a way to manage risk and protect against market volatility. By building a diversified portfolio, investors can reduce the impact of market fluctuations on their overall financial health.

- Minimizing Risk and Protecting Assets: The book provides valuable advice on how to manage risk and protect your assets. Graham’s approach to investing is based on careful analysis and a long-term outlook, helping readers safeguard their wealth in uncertain economic conditions.

- Emphasizing Financial Discipline: Graham advocates for disciplined financial behavior, encouraging readers to avoid speculative investments and stay committed to their long-term goals. By sticking to a well-thought-out strategy, investors can weather market downturns and emerge with a stronger financial position.

Essential Financial Literacy for Adults

The Intelligent Investor isn’t just about stocks and bonds—it’s about developing a broader understanding of financial markets and mastering the skills needed to make smart financial decisions. This book is a valuable resource for anyone looking to improve their financial literacy and take control of their financial future.

- Mastering Market Trends: Graham explains how to interpret market trends and make informed decisions based on economic indicators. By understanding market cycles and identifying opportunities for growth, readers can make better financial decisions and capitalize on investment opportunities.

- Making Informed Investment Choices: The book teaches readers how to perform thorough research and analysis before making any investment decisions. This approach helps ensure that your financial choices are based on solid data and not influenced by emotional reactions to market fluctuations.

- Developing Financial Independence: By following the principles in The Intelligent Investor, readers will be well on their way to achieving financial independence. The book provides the tools and knowledge needed to take control of your finances, make smart investment decisions, and build long-term wealth.

Creative Uses for The Intelligent Investor

- Personal Finance Education: Use The Intelligent Investor as part of a personal finance education plan to deepen your understanding of investing, stocks, and market behavior.

- Investment Strategy Development: Apply Graham’s principles to develop your own long-term investment strategy. The book’s timeless lessons can be used to build a customized approach to managing your portfolio.

- Incorporate into Financial Planning Workshops: Financial educators and coaches can use The Intelligent Investor as part of workshops or classes on investing and financial literacy.

- Gifting to Aspiring Investors: The Intelligent Investor makes an excellent gift for anyone interested in improving their financial literacy and learning how to make smart investment decisions.

- Investment Clubs and Study Groups: Join or start an investment club and use The Intelligent Investor as a study guide to discuss key investment principles with other like-minded individuals.

Take Control of Your Financial Future with The Intelligent Investor — A Comprehensive Guide for Adults on Mastering Financial Management and Building Wealth

The Intelligent Investor, written by Benjamin Graham, is widely regarded as one of the most important books on investment and financial management ever published. Known as the father of value investing, Graham offers a deep dive into the core principles of investing, helping readers understand the intricacies of the stock market, how to build long-term wealth, and how to protect their assets from market volatility. With its timeless wisdom, this book is an essential guide for adults who want to achieve financial success, develop disciplined investing habits, and make informed decisions that lead to lasting financial security.

In a world filled with complex financial products, speculative opportunities, and unpredictable market swings, The Intelligent Investor serves as a beacon of clarity and practicality. Graham’s core philosophy revolves around the concept of value investing, a strategy that focuses on buying undervalued stocks with strong potential for long-term growth. Rather than chasing after short-term market trends or engaging in speculative trading, The Intelligent Investor advocates for a disciplined, patient approach to building wealth over time. This method is especially relevant for adult investors who are looking to secure their financial future, avoid common mistakes, and invest wisely for the long term.

Whether you’re just starting your financial journey or you’re an experienced investor looking to refine your strategies, The Intelligent Investor provides valuable insights into risk management, portfolio diversification, and understanding market behavior. By following Graham’s advice, you’ll be better equipped to navigate the ups and downs of the financial markets, make sound investment choices, and achieve your financial goals with confidence.

Key Features and Benefits of The Intelligent Investor

Master the Fundamentals of Value Investing

At the heart of The Intelligent Investor is the concept of value investing, a proven strategy that focuses on purchasing stocks that are undervalued by the market. This method is ideal for investors who want to build long-term wealth without taking unnecessary risks. Graham’s teachings on value investing remain just as relevant today as they were when the book was first published, making it a must-read for anyone serious about financial management.

- Identify Undervalued Stocks: Graham provides clear guidelines on how to identify stocks that are priced below their intrinsic value. He emphasizes the importance of conducting thorough research, evaluating a company’s financial health, and looking for opportunities that offer strong potential for long-term growth.

- Avoid Speculative Investments: One of the key lessons of The Intelligent Investor is the danger of speculative investing. Graham warns against chasing short-term trends or trying to time the market, advocating instead for a disciplined approach that focuses on long-term success.

- Value-Based Decision Making: By teaching readers to focus on a stock’s intrinsic value rather than market hype, The Intelligent Investor helps you make investment decisions based on solid financial analysis. This reduces the emotional reactions that often lead to poor financial choices, especially during times of market volatility.

Gain a Deep Understanding of Risk Management

One of the most critical aspects of successful investing is managing risk effectively. The Intelligent Investor teaches readers how to protect their investments from unnecessary risks and market fluctuations. Graham’s emphasis on risk management is particularly beneficial for adults who want to build a stable financial future while minimizing the potential for significant losses.

- Balance Risk and Reward: Graham explains how to strike a balance between risk and reward by choosing investments that align with your financial goals and risk tolerance. He offers practical advice on how to evaluate different investment opportunities based on their risk levels and potential returns.

- Minimize Losses During Market Downturns: The Intelligent Investor provides strategies for weathering market downturns and protecting your portfolio during periods of economic uncertainty. By focusing on long-term goals and avoiding panic selling, Graham’s approach helps investors stay calm and make rational decisions even in turbulent markets.

- Diversification Strategies: Diversification is a key principle in Graham’s approach to investing. He emphasizes the importance of spreading your investments across different asset classes to reduce risk. By creating a diversified portfolio, you can protect your wealth from significant losses while still capitalizing on growth opportunities.

Understand Market Behavior and Investor Psychology

A major theme of The Intelligent Investor is the importance of understanding how markets work and how investor psychology influences market trends. Graham provides valuable insights into how fear, greed, and other emotions can drive market fluctuations, often leading to irrational investment decisions. By learning to recognize these patterns, you can avoid the common traps that ensnare many investors.

- The Market as a Voting Machine vs. a Weighing Machine: Graham famously describes the stock market as a “voting machine” in the short term, driven by popularity and speculation, but as a “weighing machine” in the long term, reflecting the true value of companies. This analogy helps investors understand why markets can be volatile in the short term but generally reflect the true value of investments over time.

- Control Emotional Reactions: One of the core messages in The Intelligent Investor is the importance of controlling emotional reactions to market events. Graham advises investors to stay calm and stick to their investment strategy, rather than reacting impulsively to market news or short-term price movements.

- Beating the Market is Not the Goal: Graham teaches that the goal of the intelligent investor should not be to “beat the market” but to achieve steady, reliable returns over time. This long-term perspective encourages investors to focus on building wealth gradually, rather than taking unnecessary risks in an attempt to outperform the market.

Learn to Build and Maintain a Strong Investment Portfolio

The Intelligent Investor provides a clear roadmap for building and maintaining a strong investment portfolio that aligns with your financial goals. Whether you’re saving for retirement, building a college fund, or simply growing your wealth, the book offers practical strategies for creating a portfolio that balances growth potential with risk management.

- Creating a Balanced Portfolio: Graham emphasizes the importance of balance in your investment portfolio, with a mix of stocks, bonds, and other assets that suit your financial objectives and risk tolerance. He provides practical advice on how to structure your portfolio to achieve steady returns while minimizing risks.

- Rebalancing Your Portfolio Over Time: As markets change, Graham advises investors to regularly review and rebalance their portfolios to ensure they stay aligned with their long-term goals. This strategy helps maintain a healthy balance between growth and security, ensuring that your investments continue to meet your needs.

- Investing with Discipline: Throughout the book, Graham emphasizes the importance of maintaining discipline in your investing. This includes sticking to a consistent strategy, avoiding speculative investments, and regularly reviewing your portfolio to make informed adjustments based on market conditions.

Essential for All Levels of Investors

Whether you’re new to investing or have years of experience, The Intelligent Investor offers valuable insights that can help you improve your investment strategy and build a more secure financial future. The book’s clear explanations and practical advice make it accessible to beginners, while its in-depth analysis and timeless principles provide value to seasoned investors.

- Beginner-Friendly Lessons: For those just starting out, The Intelligent Investor breaks down complex investment concepts into simple, easy-to-understand language. It provides a solid foundation for understanding the stock market, risk management, and long-term investing strategies.

- Advanced Insights for Experienced Investors: More experienced investors will find advanced insights into market behavior, value investing, and portfolio management. Graham’s timeless principles can help refine your existing strategies and provide new perspectives on long-term wealth-building.

- Timeless Financial Wisdom: The principles outlined in The Intelligent Investor have stood the test of time, remaining relevant across decades of market changes. Whether you’re navigating a bull market, a bear market, or economic uncertainty, Graham’s teachings provide a reliable framework for making informed investment decisions.

Creative Uses for The Intelligent Investor

- Personal Financial Mastery: Use The Intelligent Investor as a guide to mastering your personal finances, from building a diversified investment portfolio to managing risk effectively.

- Financial Planning Workshops: Financial educators can incorporate this book into workshops or classes to teach individuals about long-term investment strategies, risk management, and value investing.

- Investment Study Groups: Join or start an investment study group where participants read and discuss The Intelligent Investor to better understand key investment principles and apply them in real-life scenarios.

- Gifting to New Investors: Give The Intelligent Investor as a gift to anyone starting their investment journey. It’s an invaluable resource that will set them on the right path to financial success.

- Long-Term Retirement Planning: Use the book to help plan for retirement, learning how to build a portfolio that generates steady returns and minimizes risk over time.

Why Choose The Intelligent Investor?

The Intelligent Investor by Benjamin Graham is one of the most respected and enduring books on investment strategy and financial management. With its emphasis on value investing, risk management, and long-term financial planning, the book offers a comprehensive guide to building wealth intelligently and sustainably. Graham’s clear, practical advice has helped countless individuals achieve financial success, and his teachings remain just as relevant today as they were decades ago. Whether you’re new to investing or an experienced professional, The Intelligent Investor provides the knowledge, tools, and strategies you need to take control of your financial future.

Invest in your financial success with The Intelligent Investor and start making informed, intelligent investment decisions that lead to lasting wealth and financial independence!

Reviews

There are no reviews yet.